2021 individual federal income tax rate brackets

New York Tax Brackets 2020 - 2021. The Iowa deduction for federal income tax paid is limited to 50 of the qualifying federal tax.

Federal Income Tax Get A Clear Understanding Accounts Confidant

380 reducing the states top marginal individual income tax rate from 6925 to 65 percent while consolidating seven individual income tax brackets into five.

. Imposes tax on income using by graduated tax rates which increase as your income increases. FreeFile is the fast safe and free way to prepare and e- le your taxes. There are seven tax brackets for most ordinary income for the 2021 tax year.

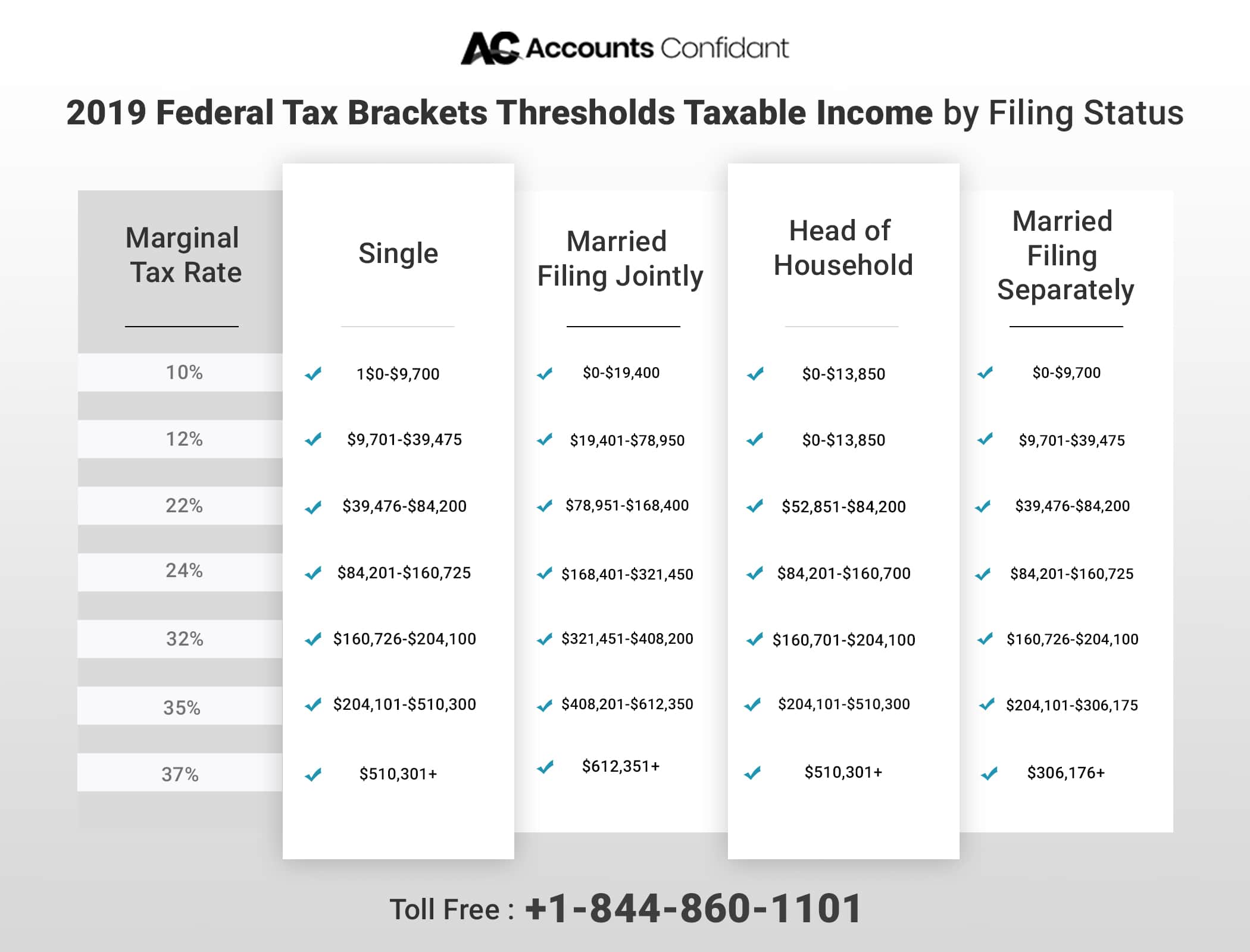

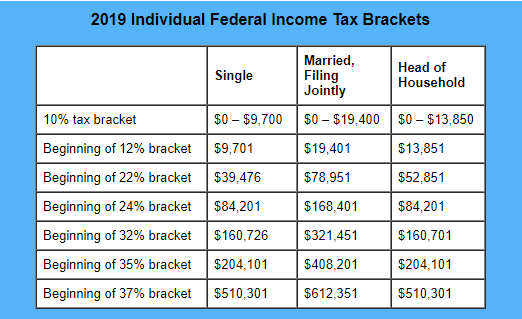

There are seven federal tax brackets for tax year 2022 the same as for 2021. The other six tax brackets set by. 10 12 22 24 32 35 and 37.

But as a percentage of your income your tax rate is generally less than that. There are seven federal tax brackets for the 2021 tax year. Federal Tax Rates and Brackets.

Find Your Federal Tax Rate Schedules. 33 of taxable income over 221708. 26 on the portion of taxable income over 98040 up to 151978 and.

TurboTax will apply these rates as you complete your tax return. The tax year 2021 tax brackets are also already available. Looking at the tax rate and tax brackets shown in the tables above for South Carolina we can see that South Carolina collects individual income taxes similarly for Single versus Married filing statuses for example.

2021-2022 federal income tax brackets rates for taxes due April 15 2022. Federal Tax Bracket Rates for 2021. The additional 38 percent is still applicable making the maximum federal income tax rate 408 percent.

For tax year 2021 the top tax rate remains 37 for individual single taxpayers with incomes greater than 523600 628300 for married couples filing jointly. 10 12 22 24 32 35 and 37. First here are the tax rates and the income ranges where they apply.

These are the federal income tax brackets for 2021 and 2022. The personal exemption for tax year 2021 remains at 0 as it was for 2020. The top marginal income tax rate of 37 percent will hit taxpayers with taxable income of 523600 and higher for single filers and.

We can also see the progressive nature of South Carolina state income tax rates from the lowest SC tax rate. These changes were retroactive to January 1 2021. These tax rate schedules are provided to help you estimate your 2021 federal income tax.

Your tax bracket is the rate you pay on the last dollar you earn. 2020 and 2021 Tax Brackets. Personal income tax rates begin at 10 for the tax year 2021the return due in 2022then gradually increase to 12 22 24 32 and 35 before reaching a top rate of 37.

24327A TAX AND EARNED INCOME CREDIT TABLES This booklet only contains Tax and Earned Income Credit Tables from the Instructions for Form 1040 and 1040-SR. The tax shall be determined by applying the tax table or the rate provided in. A tax exemption excludes.

This elimination of the personal exemption was a provision in the Tax Cuts and Jobs Act. This history is important because it shows that the tax law is always changing. If you receive an extension of time to file your federal income tax return you will automatically be granted an extension of time to file your Missouri income tax return.

These are the rates for taxes due. File Pay Apply for a Business Tax Account Upload W2s Get more information on the notice I received Get more information on the appeals process Check my Business Income Tax refund status View South Carolinas Top Delinquent Taxpayers. The highest income tax rate was lowered to 37 percent for tax years beginning in 2018.

There are seven federal individual income tax brackets. What this Means for You. The due date for the 2021 Missouri Individual Income Tax Return is April 18 2022.

On May 10 2021 Governor Brad Little R signed HB. Tax Changes for 2021 - 2022 - 2020 rates have been extended for everyone. Looking at the tax rate and tax brackets shown in the tables above for New York we can see that New York collects individual income taxes differently for Single versus Married filing statuses for example.

For tax year 2020 while there were no rate changes the IRS has adjusted Federal tax brackets for inflation by approximately 075-1. Dec 16 2021 Cat. South Carolina Tax Brackets 2022 - 2023.

The following are the federal tax rates for 2021 according to the Canada Revenue Agency CRA. As noted above the top tax bracket remains at 37. These tax rates are the same for 2022 but they apply to different income levels than in 2021.

For tax years beginning during the 2021 calendar year tax year 2021 the Iowa deduction for federal income taxes paid by a corporation is allowed only to the extent the payment was for taxes due for a tax year beginning prior to January 1 2021. 15 on the first 49020 of taxable income and. An individuals average rate which is referred to as the effective tax rate is their overall federal tax liability.

We can also see the progressive nature of New York state income tax rates from the lowest NY tax rate bracket of. Your tax bracket depends on your taxable income and your filing status. 29 on the portion of taxable income over 151978 up to.

See chart at left. Your bracket depends on your taxable income and filing status. The federal corporate income tax system is flat.

Online is defined as an individual income tax DIY return non-preparer signed that was prepared online either. These are the federal income tax brackets for 2021 and 2022.

5 Outstanding Tax Strategies For High Income Earners

Federal Income Tax Brackets Brilliant Tax

:max_bytes(150000):strip_icc()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-02-822f6b88f3fe437caed0b5ca5bc51bdf.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Federal Income Tax Get A Clear Understanding Accounts Confidant

Federal Income Tax Brackets Brilliant Tax

Michigan Family Law Support Jan 2021 2021 Tax Rates 2021 Federal Income Tax Rates Brackets Etc And 2021 Michigan Income Tax Rate And Personal Exemption Deduction Joseph W Cunningham Jd Cpa Pc

How To Calculate Federal Income Taxes Social Security Medicare Included Youtube

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

Michigan Family Law Support Jan 2021 2021 Tax Rates 2021 Federal Income Tax Rates Brackets Etc And 2021 Michigan Income Tax Rate And Personal Exemption Deduction Joseph W Cunningham Jd Cpa Pc

Pin On Taxes

2018 Irs Federal Income Tax Brackets Breakdown Example Married W 1 Child My Money Blog

What Is My Tax Bracket 2021 2022 Federal Tax Brackets Forbes Advisor

Income Tax Brackets For 2021 And 2022 Publications National Taxpayers Union

2021 Federal Tax Brackets Tax Rates Retirement Plans Western States Financial Western States Investments Corona Ca John Weyhgandt Financial Coach Advisor

Federal Income Tax Brackets Brilliant Tax

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

Low Tax Rates Provide Opportunity To Cash Out With Dividends